Whether you have a few contacts or none for your wholesale real estate business … are you ready to build your cash buyer’s list?!

Let’s go!

Question: What could possibly beat the exhilaration of flipping that sweet wholesale deal of yours for a tidy payday with only, say, an hour or two of your actual time involved?

Answer: The euphoria of doing so within mere hours of putting it under contract.

Maybe even minutes.

Sound far-fetched? Too good to be true?

It’s all in the wrist list.

As in, building and cultivating your own ridiculously awesome list of hungry cash buyers for real estate – waiting, salivating, just hoping to stick a fork in the next juicy wholesale deal you’ve cooked up and served on a silver platter.

When it comes to wholesaling houses for quick cash, anyone who’s been at this for at least 37 seconds already gets the raw juice that having a solid list of cash buyers on tap can do for your wholesaling endeavors.

No buyers, no profits – know buyers, know profits.

(lol, see what I did there?)

Brace yourself …

In this “Knowledge Bomb,” I’m about to drop 33 time-tested, proven cash buyers list-building maneuvers on that pretty little head of yours.

I’m talking, a treasure trove of ways you can create that goldmine list of active investors, with capital on hand, and eager to share their buying criteria with you in hopes of snatching up one of the good ones.

This should be the last thing you ever need to read on how to build a cash buyers list.

This cash buyer’s list – basically a mini cash buyer’s course – is the culmination of what we’ve learned of cash buyer-getting thus far in over two and a half decades in the real estate game.

You might even want to go ahead and bookmark this for future reference because there’s no way you can use all of these ideas at once unless you’re from Hogwarts or a robot from the future.

Use even a fraction of these tactics and you’ll quickly have all the cash buyers for wholesale deals you need.

Deploy half or more of them, and I guarantee you’ll be a cash buyer ninja with the biggest, awesomest buyers list in your whole freaking area, hands down.

OK, I can hear you asking it in my mind (outta my head, you sicko!), so let’s go ahead and answer before we dive in:

“Do you really need a ginormous cash buyer’s list to win at wholesaling?”

Nah, of course not. But also, it doesn’t exactly hurt either.

Let me explain…

During my first few years wholesaling houses (starting back in 2001), I only had like 3 or 4 guys I ever flipped contracts to.

They were solid, local players with years of experience notched on their belts, cash on hand, and the ability to act fast and close quickly if needed.

I only needed these 3-4 guys in my corner to close around 40-something deals my first year in the game. Not too shabby.

But also, consider that having a veritable stockpile of cash buyers on tap gives a couple of unique benefits:

- First: You have by default a wider net to fit your deals into. More cash buyers = more diverse buying criteria = more opportunity for you to craft a deal from those leads you’re sorting and sifting.

- Second: A bigger cash buyers list can attract even more deals to come your way because once word hits the street with other investors that you’ve achieved “Buyers List Level: Expert,” something interesting happens: Other investors start bringing you their deals to sell to your buyers.

Think about it…

Once you get a rep for selling contracts in hours instead of days or weeks, suddenly, you become the path of least resistance when their first couple of attempts to work their flaccid little buyers list don’t exactly pan out.

So having the biggest, baddest buyers list in town can actually give you more deal-making options while making you a co-wholesaling magnet, which means more easy money in your pocket.

This has happened to us many times, and it freaking rocks.

Having said all that, it really doesn’t matter what your personal philosophy for the ‘ideal’ cash buyers list is – the tactics you’ll read below are more than enough to get you there.

How This Cash Buyer’s List Is Organized

Just an FYI: rather than try to sort these finding cash buyers strategies by some kind of value, I’ve gone with no particular order, except for grouping them into 3 main categories:

If a tactic could fit in more than one group, I just picked one.

And hey, I bet you a whole dollar you’ll find more than one clever, outside-the-box strategy you never would have thought up yourself.

OK then, let’s do this…

33 Ways To Build Your Cash Buyer’s List

Hi, I’m Awkward (Networking Tactics)!

Tactic #1: Local REIA

It may already be painfully obvious, but your local real estate investing association (REIA) is a watering hole for all manner of investors, including rehabbers and landlords you need to be connected with.

Go to the meetings! But don’t just randomly collect business cards. Rub shoulders and shake hands, but do more listening than talking, and look for ways to make authentic connections with the players you identify in the room.

Pro Tip #1: Look for ways you can be more involved than merely being a regular member showing up for meetings.

Be more visible by volunteering to help somehow or even teach something.

Consider buying an ad in the club newsletter to promote your wholesaling business or even becoming a corporate sponsor.

I signed our company up for Gold Sponsorship with our REIA, which gives us a primo ad in their newsletter and website. Plus, a spotlight opportunity at every meeting to stand up and let any cash buyers in the room know we’re the best deal-pushers in town.

From this alone, we add a stack of fresh cash buyers to our list every single month.

Pro Tip #2: Contact the REIA president and see if they would consider sharing one of your sweet deals with their cash buyer list for a profit cut.

Tactic #2: Meetup.com

Meetup is an online social networking portal that facilitates offline group meetings in various places around the world.

Basically, you can find and join common interest groups, like politics, books, gamers, Anime, guys who like to drink beer and watch movies in their garage on Thursday nights, or whatevertheheckelse.

Not long ago, I was looking for co-wholesale partners, and I found them by searching for meet-ups in the area. There were several REI-related groups, so I joined the meet-ups and posted to their message board, with multiple responses to show for it.

Pro Tip: I even decided to start my own meetup group at a local pizza joint, and it’s been an invaluable network builder for us to run this group, including adding multiple cash buyers to our list on a regular basis. Do definitely give that a try.

Tactic #3: Closing Attorney/Title Agent

Think about it: who knows the ‘cash players’ better than the attorneys and title agents closing their deals?

They already have a vested interest in keeping a great thing going with them, so why wouldn’t they want extra brownie points for a warm intro to another awesome client who can help them keep making even more money doing (and closing) great deals?

So next time you’re at your title company’s closing table, just ask them: “Hey, who else do you do closings for that pays cash for houses? Do you think they might ever be interested in any of the wholesale deals you’ve seen me doing? … Great, would you mind making a friendly introduction, please?”

Pro Tip: Title companies can also often sell (or give) you a list of all cash transaction buyers who’ve purchased a certain number of properties in a certain zip, with a specific price and date range. Just ask them if they can help you out with this kind of info.

Tactic #4: Hard Money Lenders

Keep in mind that not all your buyers need literal cash in the bank – investors who utilize hard money can also be perfectly fine for wholesale deals, so long as you know there’s still a qualifying factor involved.

So reach out to any local hard money lender and make a personal connection, then see how they’d feel about introducing you to any of their local investor-borrowers who might be interested in doing more great deals.

Pro Tip: If they can’t/won’t connect you for some reason, you can work around them. In your county’s online public records, look up what properties your local HMLs have liens on, then look up the owners. Ka-pow!

Tactic #5: Landlords with Houses for Rent

It’s a no-brainer that landlords who already own performing rentals could be interested in buying more if they like the area and numbers.

So reach out to any/all landlords advertising houses for rent and ask if they’re interested in possibly acquiring another solid cashflow property. If yes, continue the discussion from there to find out their criteria.

Pro Tip #1: I highly recommend doing this systematically so that (i) you’ll be consistent with it and (ii) you’ll hopefully avoid pinging the same landlords over and over.

So, for example, you could set a weekly task for your virtual assistant to collect any/all new landlord contacts from Zillow, Craigslist, newspaper, etc., and add them to a spreadsheet or database, making sure to eliminate any duplicates and/or known property management companies. Then, monthly, have him send a text and/or voice mail blast to everyone new on the list.

You can easily send voice and/or text broadcasts with Call Fire. Our current preference is sending group text blasts with Mighty Text Pro (Android only) and direct-to-voicemail messages through Sly Broadcast (Also, we make our message sound like a one-off call they just happen to miss rather than a group broadcast to the masses)

Pro Tip #2: If a landlord you speak with seems burned out, spin the conversation into asking them if they’d like to solve that problem by selling to you instead. Boom, motivated seller.

Tactic #6: Section 8

We’ve all heard of Section 8 housing, the gov’t program some landlords use to get guaranteed rent. But have you ever considered mining Section 8 for cash buyers?

Here’s how it works: Local Section 8 offices typically retain a list of ‘approved properties’ for the Section 8 voucher program, including contact information for each landlord.

This list may be readily available just for the asking, so call up the local housing authority and find out. If not, visit your local housing authority and personally meet the rep there. Tell them you’re a local property investor considering housing options for the Section 8 market but would like to see what kinds of other properties are already available by comparison.

One way or another, get the list, then reach out to every landlord on the list as already described. It’s a quick and easy way to find cash buyers and even get a peek into the basic criteria of their investments.

Pro Tip: AffordableHousing.com is a little-known website where landlords can list Section 8 properties they have for rent along with their contact information. Do a zip code search to pull up all the Section 8 rentals located in your area, and you know what to do from there!

Tactic #7: Property Management Companies

Just like closing attorneys and hard money lenders, these guys have direct working relationships with major players and a vested interest in keeping them happy as a tick on a fat dog.

So reach out to any/all reputable property managers and straight up ask them if they’ve got actively buying owners who might be interested in acquiring new cash flow assets. Which, of course, means more future properties under their management.

Pro Tip: In most areas, property managers are legally required to be licensed real estate agents. So if warm fuzzies and more houses to manage aren’t a big enough carrot, why not dangle a little commission in front of them on the first 2-3 properties any of their referrals buy from you? Incentivize, yo.

Tactic #8: Homevestors

Love ‘em or hate ‘em, these guys have an unmistakable presence in about every major U.S. city.

What’s more, I’ve noticed that they tend to be rehab-centric investors who kinda-sorta-hafta keep churning deals to keep feeding that hungry franchise machine they’ve signed on for.

So, you should definitely reach out to your local HV folks and add them to your cash buyers list. Just go to their website, and you’ll easily find your local franchise owner(s) in a few quick clicks.

Tactic #9: Attend Auctions

Visit local property auctions and target the folks bidding and buying the most. Whether private auctions, local trustee/foreclosure auctions, tax deed sales, or whatever the heck else, the active bidders here are supremely valuable to you.

The specific rules can vary based on the area and scenario, but these guys almost always have to verify having large amounts of “good funds” available at the auction in order to even bid. You want them. So go to these auctions and meet them in person.

Use your people skills and rub shoulders with them, but don’t make it weird. They tend to be a jaded bunch, so you might have to go a few times before they’ll even let you talk to them.

Have your thoughts organized before an approach, and try pulling just one of them off to the side rather than trying to broadcast en-masse how awesome your wholesale contracts are.

But trust me, it’s worth it. Most investors who buy at auctions are used to making fast decisions on a deal and are only ever used to buying deals from auctions. Once you start pushing good deals their way, they’ll wonder where you’ve been all their life.

Pro Tip: In some areas, the folks bidding at auctions can actually be from a buying or bidding service that works on behalf of investors who don’t want to attend the live auctions themselves. If you find out so, then go online and research properties this company purchased, including who they transferred the sale to. Boom, back door cash buyers.

Tactic #10: Self-Directed IRA Gatherings

Hardly anyone ever thinks of this one, but it’s a freaking goldmine.

Find local Self-Directed IRA custodians (Entrust, Equity Trust, there are many more) and ask them if they hold investing meetings or “lunch and learns” anywhere in the area.

Network the crap out of them.

These people have capital (in their SD IRA!) they need to have people out there working for them. They’re often interested in real estate but lack the know-how or time to actually find deals.

So you show up and present yourself as the local real estate investor expert who specializes in finding diamond-in-the-rough property deals.

Next thing, you’re their pusher.

Pro Tip: Maybe it’s obvious, maybe it’s not. But in addition to courting these guys as cash buyers, their “lazy IRA money” also works superdy duperdy great as a source of private money for your deals. Yep, a twofer

Tactic #11: Accountants

CPAs have clients with money. And many CPAs have clients who want to invest said money. And like other professionals already listed here (closing attorneys, hard money lenders, property managers) CPAs also have a vested interest in making their favorite clients crazy happy.

So ask any CPA you know (or meet) if they think any of their clients might be interested in investing in some local discounted real estate if it’s a truly smoking deal. From there, you can connect the dots.

Pro Tip: Ask other experienced investors you know around town who their CPA is. Often it’s a CPA who already works with a lot of other local investors. Richer soil to till, amiright?

Tactic #12: BNI

With over 180,000 members worldwide, BNI is the single largest business networking organization in the world. Last year alone, they generated 6.6 million referrals, resulting in $8.6 billion dollars of business.

It’s one of those organizations with a number of local “chapters” in an area, and any given chapter can only have a single member representing any one business type.

So your chapter might have one dentist, one roofer, one landscaper, one mortgage broker, one plumber, one Realtor, one basket weaver, and, of course, one real estate investor… you.

Besides your actual chapter members being a great group of go-getters to network with (and possibly interested in real estate investments), the real power lies in the extended networks of these people.

The underlying agreement is that chapter members will support each other’s business with referrals. So when you know someone needs a dermatologist, you’ll hopefully think to refer Dr. Whitehead from your BNI chapter… and when anyone else in your chapter finds that someone in their world needs something real estate investor-related (like access to steeply discounted investment properties for example), then he’ll refer them to you.

Pro Tip: This works super great for motivated seller referrals too 😉

Tactic #13: Other Networking

Basically, you should flap your gums about what you do to anyone and everyone and look for those power networking opportunities to connect with folks who might want what you’ve got to sell.

So Chamber of Commerce, Charity Events, Rotary Club Fundraisers… basically anywhere you can position yourself with people and ‘talk shop’.

Thug Life (Street Tactics)

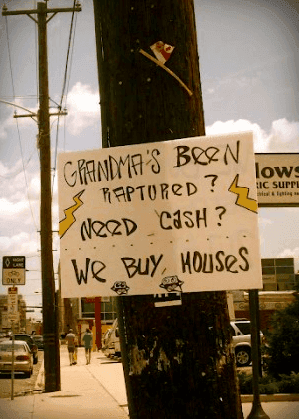

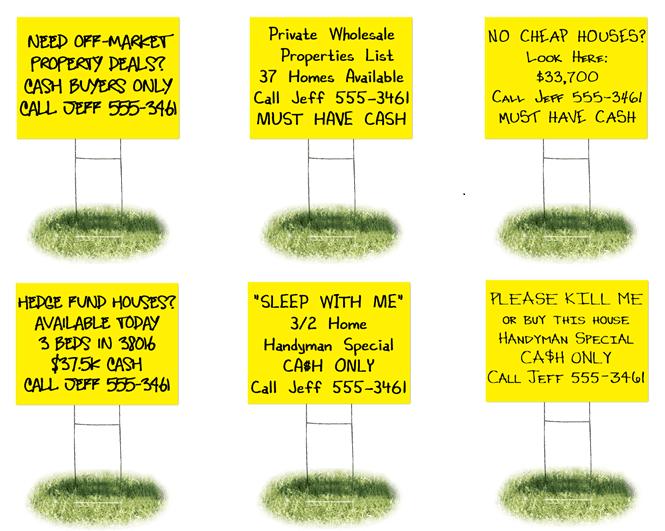

Tactic #14: Bandit Signs

About every investor on the planet Earth knows bandit signs can be a motivated seller magnet. But lesser known is the fact that they’re just as crazy effective for extracting cash buyers from the marketplace.

So whenever you have a property under contract, placing 10-20 signs on and in the neighborhood of the property will always get your phone ringing. We’ll usually pick up at least one new cash buyer every time we put a batch of signs out.

Pro Tip #1: Don’t have any properties of your own to market? Just call a few of the other wholesalers in the area and ask them if you can market one of their deals. Or conveniently leave a sign out from one of your other deals, and when the calls come in, just say, “Ah snap! Sorry, you missed that one; it’s already gone! But tell me what kind of houses you‘re looking for, and I’ll be happy to send you the next one directly…”

Pro Tip #2: Don’t make your signs fancy. Hand-written signs actually work better with these types of signs specifically because they look less professional. There’s something about this that makes you feel like it’s more likely a legit deal than if it’s a professional, pre-printed sign.

I use 12×18 blank, white or yellow, corrugated plastic signs, and then write on them with black or red permanent marker.

Pro Tip #3: Get up early on Saturday morning and go put a couple dozen of these signs all around the entrances and exits of all of the local hardware stores, Home Depots, Lowes, Ace, etc.

Pro Tip #4: You don’t have to put these out yourself. You can pay someone on Craigslist or some high school kid $1 buck per sign to do it for you. And why wouldn’t you?

Pro Tip #5: Here are six sexy ideas you can use for eyeball-grabbing cash buyer bandit signs…

Tactic #15: The Auction Houses Sneak

I’ve already covered how powerful attending auctions can be as a source for connecting with quality cash buyers. A related (and super creative) method hardly anyone ever thinks of is to actually position your message in some way at the very houses being auctioned off.

This works because most investors planning to bid will at least do a drive-by of every property they’re considering.

So go stick your sign in the yard of every house on the auction block that says you’ve got the hookup for super cheap houses. See all the previous bandit sign examples given – they’re all awesome for this.

Pro Tip: A friend of mine recently shared that he’d taken this idea up a notch after finding his bandit signs were getting stolen right after he put them in the auction house yards.

So, he started using bumper stickers instead. Same basic message as on the bandit signs. He just pays a guy to go around sticking them right on the front doors of all the houses and never has to worry about the stickers getting picked up like their bandit signs were. Ba-bam!

Tactic #16: Driving for Buyers

You’ve probably heard of “Driving for Dollars” – it’s real estate investor talk for “drive around looking for yucky houses that might be a deal worth looking into.”

Well, same logic here, but while driving the neighborhoods, you’re paying attention to the “For Rent” signs, dumpsters in the driveway, contractor vans, rehab crews at work, etc.

If there are people working on the house, stop in, introduce yourself, and find out who the owner is. If there’s a “For Rent” or “For Sale” sign in the yard, call the number and strike up a conversation with the investor to see if they are looking for more homes in the area and if so, what type of deals are they looking for?

We try to do this at least once every month or so, and usually end up adding one or two quality buyers each time.

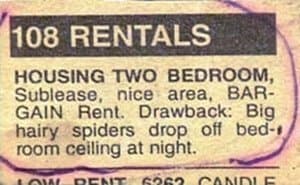

Tactic #17: Newspaper Ad

This one’s so easy. Just run an ad in the local newspaper that will get cash buyers calling you.

Yes, newspaper ads will cost you some coin, and you may wonder who actually still reads the paper anymore. But contrary to popular belief, there are a lot of people who still read the newspaper – usually the older population of folks who, by the way, will never ever see your ad on Craigslist or anywhere else online. And these people are often retired (or nearly) and interested in real estate as an investment for one reason or another. They need you.

Pro Tip #1: Most investors will place their ad in the “Real Estate Services” section. Not me. Frankly, I think hardly anyone even knows that section exists. Instead, I prefer to advertise an actual smoking deal for sale – it could be in the section of houses for sale for a specific neighborhood or maybe in the “Investment Property for Sale” section – but I want my ad in front of folks who are already perusing the paper for a house deal, not looking for “real estate services” whatever that means.

Pro Tip #2: Don’t give too much info in your ad, including any exact address. You want them to have to call and talk to you; giving them an address in your ad gives them something with which to potentially filter you out without even calling.

Pro Tip #3: Make it seem like you’re an actual motivated seller rather than a wholesaler. Don’t mention your company name or send them to a website. Just make it seem super sexy, and cash buyers will call you. When they call, find out exactly what they’re looking for and go from there.

If you don’t actually have a house for sale, you can place a ‘ghost ad’ if you need to, and just tell them, “Ah so sorry, but this deal’s already gone… but I actually come across these fairly often. Tell me exactly what you’re looking for, and I’ll be happy to call you for the next one.” If you don’t like the ‘ghost ad’ approach, then get permission to advertise another wholesaler’s contract.

This is actually how I built my first list of legit cash buyers back in the day. Exactly this. I ran an ad something like “Desperate, Must Sell Fast, 3br Fixer-Upper in U of M area, $37K OBO. Please call for details, 555-1212” – This ad got my phone ringing off the hook, and put a whole pile of cash buyers in my world.

The Internets (Web/Tech Tactics)

Tactic #18: Craigslist Pole Fishing

What started as an email list of San Francisco area events by some guy named Craig Newmark in 1995, has become the unequivocal champion of online classifieds we know today as Craigslist. With 50 billion page views/month, and 60 million folks a month using in the US alone, there’s just no bigger pond you can fish in if you’ve got something to sell, something to buy, looking for a job, or maybe just want to find some new friends to Larp with.

In terms of using Craigslist to get cash buyers, just follow the same basic strategy (including Pro Tips) described above for newspaper ads, except it won’t cost you anything: Place a “Fixer-Upper, Must Sell” type ad… don’t give too much info… make it seem like you’re a motivated seller, not a wholesaler… and when people call, find out exactly what they’re looking for.

Pro Tip: On Craigslist, we typically post (or repost) ads a couple of times a day (our VA does). And for Craigslist ads, you’ll find more of a need to really screen the calls you get to ensure they have the cash and are serious buyers. There tend to be a lot of scammers and posers in the CL space. It still rocks, but something to be aware of.

Tactic #19: Craigslist Net Fishing

This time, rather than advertising one specific property for sale to get a buyer’s attention, you’re going to offer a whole list of them. You can do this even if you don’t have your own pile of houses to offer yet. First time I tried this one we ended up with 12 new buyers in one day.

Here’s what you do:

Step 1: The Webpage – Set up a simple opt-in page (some people call them “squeeze” pages) designed to entice potential cash buyers to give you their email in return for a little sumpin’ sumpin’ you’re offering them. Speaking of which…

Step 2: A Little Sumpin’ Sumpin’ – Assemble a list of tasty house deals on the landing page – this is the page folks get after they submit their info on the first opt-in page.

Don’t have enough active/working deals right now? Go snag yourself 40-50 of the sexiest-looking active foreclosures from the MLS. If these aren’t actually your deals, just don’t present them as if you’re selling them (you aren’t). Include whatever the listing agent’s contact info is, so if folks are interested, they know who to call directly.

The goal here isn’t about actually selling these houses – it’s about getting the attention of people interested in discounted property deals, collecting their contact info, and adding it to your buyers list. While, of course, making good on what you offered them on the first page (a list of discount/foreclosure houses).

Step 3: Watch it Rain – Wait and watch what happens. The first time we did this, we had 12 opt-ins by the end of day one, about half of which were pretty darn solid.

Pro Tip: This may go without saying, but I’ll say it anyway. Don’t just start blasting these folks your property deals right after they opt-in without first reaching out and making a personal connection with them.

They need to know you personally and how valuable you can be to them. You need to know them, what their criteria are, and if they’re even actually qualified cash buyers – some of these folks will be completely unqualified to be considered “cash buyers”.

Tactic #20: MLS Mining

If you have access to the MLS or have a Realtor friend who’ll work with you, check out the recent cash sales in your selling area. Pull all sales in the last 6 months where the financing type was “cash”. Make sure they’re not owner-occupants by verifying that their tax bill mailing address is different from the property address.

Pay special attention to trends you (i.e. see multiple cash buys) – these are obviously the players.

Pro Tip: No MLS access? Run an ad on Craigslist for a “young and hungry” Realtor who’ll work with you and get you access. If needed, offer to pay a fee for them to do an MLS search for you.

Tactic #21: MLS Sniping

This is a tactic we do on an ongoing basis, but it requires direct MLS access one way or another. Basically, whenever we’re running MLS comps for any property, one of our standard procedures is to quickly assess the other properties in the area that sold for cash recently.

This is because we want to get our head around what other investors are paying for distressed properties right in that little area. Plus, these same investors might actually be interested in the house we’re comping.

So while doing this, we have our VA simply add any investor-buyers’ names and tax-bill mailing addresses into a document – just a simple copy, paste it, and save it for later.

So basically, as we’re comping potential deals in our day-to-day, we’re simultaneously ‘sniping’ known cash buyers readily visible in the comps and slowly building a list of them. Then, once a month or so, we’ll send them a letter offering them the chance to connect if they’re interested in more sweet deals like the one they recently purchased.

This has worked very well for us, and it is extremely easy to systematize and out-task to an assistant.

Tactic #22: HUD & Seek

HUDHomeStore.gov is where investors go to bid on HUD homes. But few investors ever realize what a treasure trove it can be for uncovering qualified cash buyers.

All you have to do is take a gander at the previous bid results. Record each sale in a spreadsheet, then check the property address in public records to get the investor’s name and mailing address for the tax bill. (This will have to be 30-60 days after the sale to give the new deed time to be recorded.) Ba-bam! You now have a list of investors actively bidding on HUD homes.

Pro Tip #1: While at HUD Home Store, you can also snag the real estate agent’s name in the transaction, many of whom specialize in HUD Foreclosures and have a handful of cash buyers they work with.

Pro Tip #2: If you have a VA on your team, you can easily have him/her systematically do all of this for you. Duh.

Tactic #23: The Googles

This one’s stupid-easy. Just do a quick search for common investor keywords, then pick up the phone and call them. So, for example, run a Google search for:

- we buy houses (your city name)

- sell house fast (your city name)

- wholesale properties (your city name)

Those are just a few examples to get you started. What you see in the results will mostly be a combination of fix-and-flip investors and other wholesalers. Either way, you should connect with all of them, but obviously, the rehabbers are typically solid cash buyers.

Pro Tip: What you’ll see in the results are both (i) ‘natural’ search results and (ii) paid ads focusing on those keywords. It’s easy sometimes to ignore the ads on Google due to the conditioned “ad blindness” most of us have. But you should definitely pay attention to them because these folks are actually spending money to advertise their business.

Tactic #24: Freedomsoft

If you’ve been in REI for a minute, then you’ve probably heard of Freedomsoft. From transaction management to all manner of docs & forms to marketing campaign management to faxing and emailing offers en masse, this software does a crapload of stuff, including offer access to tons of cash buyers all around the country you can pull up with a few clicks. So, if you have a Freedomsoft account, just use the cash buyers tool. Easy peasy.

Pro Tip: I recommend systematizing this by having someone on your team pull FS cash buyers every couple of months and drop them a letter. I also recommend focusing on people who’ve purchased at least 2 or more houses in the last year. The one-off buyers are much less likely to be actual real estate investors vs. buyers who just happen to pay cash for their home.

Tactic #25: ListSource

Much like Freedomsoft, you can download a list of cash buyers from ListSource, but rather than subscribing to a full-featured REI CRM, you can just buy a one-off list of leads. So, for example, you can buy a list of recent cash sales (last 6 months) and send them a yellow letter or postcard.

Pro Tip: They don’t really just have a box to check for “cash buyers list”. Basically, you start by creating a custom list, choosing your geographical area of choice, then under the “Property” link, clicking on “Last Sale Date” and choosing the last 12 months. Then click on “Equity Percentage” and type in 90-100%. Then go to “Options” and select Absentee. This gives you the investors buying with cash. As mentioned before, I recommend filtering down further to those who have bought at least 2 properties.

Tactic #26: Adwords / Pay-Per-Click (PPC)

Google’s PPC marketing can absolutely be one of the most effective and fastest ways to get your offer in front of people online, period.

Whether motivated sellers, tenants, rent-to-own tenants… or, yes, cash buyers, people who really learn to harness the power of Google PPC can really make it rain. But it can also eat your lunch if you’re not careful. It just takes a fair bit of work, time, and some trial and error to really crush it with Google PPC.

For this reason, I don’t typically recommend people start with Adwords marketing right away unless you’re hiring an expert to create and manage your PPC campaigns for you. But the sheer power of what it has to offer in terms of lead generation merits it being included in this list.

If you want to learn about Google PPC, I recommend starting by picking up Perry Marshall’s Ultimate Guide to Google Adwords on Amazon. Read through that to learn the ropes, then give it a try on a small scale.

Pro Tip: Remember PPC means “Pay-Per-Click” so you only pay when people actually click your ad. One sneaky (but perfectly legit) way you can stretch your online marketing budget is to place your phone number in the actual ad text. That way, your cash buyer leads don’t even have to click your ad to reach out to you; they can just call.

Tactic #27: Facebook Ads

Ever heard of Facebook? Yeah. More traffic than Google nowadays. Crazy, I know. And I’m sure you’ve noticed those little ads on the side or inserted into your FB feed, right?

Well, like Google, Facebook ads are Pay-Per-Click, but one of the biggest benefits FB has over the big G is how ridiculously granular and specific you can get by drilling into specific types of people with your ad.

So, if you want your ad to be location-specific – meaning having your ad only seen by people within a certain number of miles, you can do it. On top of that, FB ads can also be interest-specific – meaning you can choose to show your ad only to people who are interested in a certain topic.

So you could advertise only to folks who “like” Flip This House, Rich Dad Poor Dad, or who belong to certain FB groups, like “House Flippers of Des Moines”. And to bring it home, you can even target down to specific demographics if you want, such as age or gender.

Can you see the power here? With these kinds of filters, your ads can be super freaking hyper-targeted to specific types and groups of people.

When crafting your Facebook ad, think of it kinda like a little bandit sign. Same idea, really, except unlike with bandit signs, you also get to include a picture too – fun! In terms of creating a killer ad, your chief priorities are choosing (i) a killer headline and (ii) an eyeball-grabbing photo. Above all else, these two things are the keys to the castle.

Once you get your ad dialed in, drive those leads to your opt-in ‘squeeze’ page for cash buyers, and you know what to do from there.

Pro Tip: For your ad pic, take a photo of your bandit sign and use the same copy on the ad. Also, as suggested with Google PPC, try placing your phone number directly in the ad so they don’t even have to click, which saves you money.

Tactic #28: Facebook Groups

In case you’ve never realized it, you can actually search Facebook for local groups, such as groups of people who invest in your area.

We recently had a lead in an entirely different state where I don’t have any investor friends. I hopped on FB and quickly found a group that was full of investors doing deals in that city. So, I joined the group and found a cash buyer in less than 24 hours.

Facebook’s a freaking goldmine, I tell ya.

Tactic #29: LinkedIn

LinkedIn may not get the same press as Facebook, but make no mistake, LinkedIn can be an incredible resource for social networking in a more professional way. And it’s chocked FULL of real estate investors, many of whom are hungry cash buyers looking for deals like yours. Alls you gotta do is find and make a connection with them.

Here’s how: First, search through LinkedIn for REI-relevant groups in your area. Much like Facebook, LinkedIn relies heavily on groups to serve as common interest ‘watering holes’, and it’s not hard to uncover a whole big pile of them, many of which will have tens of thousands or even 100K+ members.

Next, join these groups. Because once you’re in the same group as someone else, LinkedIn will let you send out messages to them without paying. As you make connections, find out who’s actually buying properties and who isn’t.

Viola, now you’re adding fresh cash buyers to your buyers list through LinkedIn. You’re welcome. 🙂

Tactic #30: eBay

Got this ninja idea from a colleague who one time had this complete junker of a house she basically got for free. She decided to post it on eBay with the starting bid at only $100 bucks to see what would happen.

This naturally got a lot of attention, and things quickly heated up to over 50 bids. Of course, only one guy ended up winning the house. But she also ended up with 49 other folks who effectively raised their hand as interested buyers, most of whom turned out to be highly qualified cash buyers definitely interested in buying more in the area. She even picked up several international buyers in the bunch.

Tactic #31: Find Cash Buyers Now

FindCashBuyersNow.com is a subscription-based platform developed specifically to “help real estate entrepreneurs to identify the most active cash buyers in their local areas”.

My guess is they probably mine their data from public records, though I am not 100% certain. I haven’t used their data extensively because, from what I can tell, the results seem to be very similar to what can be pulled through Freedomsoft.

I honestly have no clue if they get their data from the same or different sources, But Freedomsoft is a much more robust system with lots of other fancy bells and whistles (cash buyers being one of them), whereas FindCashBuyersNow.com seems to focus specifically on doing that one thing really well.

For what it’s worth, I’d guess that either of them will serve you similarly as well as the other.

Tactic #32: Agents Who Frequently Rep Cash Buyers

As I described earlier, you can use the MLS to pull a cash transactions search within the past 180 days or so, but this time, your goal is to compile a list of the real estate agents whose names you see the most.

It won’t be hard to see patterns of agents who repeatedly work with cash buyers, especially if you peruse this list on a monthly or so basis. I love working with agents with cash buyers like this because they already have a working relationship with specific cash buyers.

Pro Tip: If you’re not an agent, you’ll need to find one to pull this list for you using the MLS. But keep in mind that most agents I’ve found don’t even know this kind of list can be pulled, much less how to do it.

If so, just tell them to contact their MLS support and tell them what you’re trying to do. Essentially, all you’re trying to do is create a search of all the “sold” closings in the last 180 days that had “cash” as the financing type. This will bring up the list and then simply compile the list of the top agents that consistently work with cash buyers.

Tactic #33: Recon Other Wholesaler’s Deals

I love this sneaky little trick.

So here’s the deal: Lots of wholesalers list the homes they’ve recently sold on their website or property inventory lists. I guess it’s kind of a shy brag to their buyers about the deals that got away.

Well guess what you have there? Verified addresses of houses that sold to qualified cash buyers. So just copy and paste the address into your local tax assessor’s website and see who bought it. Now, not only do you have a new cash buyer you can contact, but you also know exactly how much they paid for the property and at least one area he/she is interested in.

Ka-pow!

The Bottom Line: The Ultimate Cash Buyer’s List

*TAKES BIG, DEEP BREATHE*

So there you have it. I hereby bequeath thee THIRTY-THREE time-tested, proven tactics you can use to get a completely ridiculous cash buyers list for your wholesale deals.

All in a day’s work.

So, let me ask you…

Which of these 33 pieces of awesome is your personal favorite?

And assuming you didn’t already know every single one of these before, which is the next one you can’t wait to try?

Oooooooh, can you think of anything not on the cash buyer’s list here that I missed?

Please chime in and leave a comment below with your answers and other thoughts. I’d really like to know.

Don’t forget to be awesome.