So, you’re dipping your toes into the world of real estate investing or trekking out to deeper waters with a new strategy?

Well, let me throw something your way — tax lien certificates. This little nugget might just be the game-changer you’re looking for.

It’s a world where savvy investors can make a pretty penny, and all it takes is understanding where and how to buy these certificates.

Stick around as I walk you through the ins and outs of tax lien states.

By the time we’re done, you’ll be itching to get your hands on one of these bad boys!

What Is a Tax Lien Certificate?

Imagine this: a property owner forgets to pay their property taxes. What happens next? The local government slaps a lien on their property. (Ouch.) That’s where a tax lien certificate comes into play.

It’s basically a claim against a property with unpaid taxes.

But here’s the kicker — these certificates are sold to investors like you through auctions. Hooray!

So, how do they work?

It all starts with your property taxes. Pay them, and all’s well. Ignore them, and the government steps in. It’ll issue a tax lien and, if you’re still not paying up, it’ll auction off that lien to an investor.

That investor, who just might end up being you, then pays the taxes owed. In return, you get a lien on the property and a certificate outlining what’s due.

Now, here’s the interesting part… not all states play this game the same way.

Some, like California, have a different playbook — they straight up sell off defaulted properties. But in tax lien states, it’s all about the certificates.

These certificates aren’t just a one-trick pony. They come with a term, usually 1 to 3 years, and allow you to collect unpaid taxes plus interest. And this interest can be a real moneymaker, ranging from 8% to over 30%, depending on where you’re investing.

When it comes to buying these certificates, it’s all about the auction. Bids can be based on the highest cash offer, the lowest interest rate, or some other method.

It’s a bit of a strategy game, but if you play your cards right, you could be raking in the returns.

What’s the Difference Between a Tax Lien and Tax Deed?

Alrighty, let’s break down the differences between a tax lien and a tax deed because, trust me, they’re as different as apples and oranges.

Tax Liens: The IOU of Real Estate

In tax lien states, when someone doesn’t pay their property taxes, the government doesn’t just shrug it off. Instead, they issue a tax lien certificate, like an IOU note, which investors can buy at auction.

You’re basically lending money to the property owner and earning interest on it. If they pay up, you get your money back with a nice little interest treat. If they don’t, well, you don’t get to own the property, but you have a claim on it.

Tax Deeds: More Than Just a Piece of Paper

Now, tax deeds are a whole different ball game. Here, if the property taxes aren’t paid, the government can actually sell the property itself, not just a claim on it. This process is called a tax deed sale.

So when you buy a tax deed, you’re not just holding a claim or an IOU — you’re buying the property. The previous owner’s loss, your gain.

Why Invest in Tax Lien Certificates?

So, why should you, a savvy investor, dive into tax lien investing? Let’s unpack this.

The Allure of Interest Rates

In the world of tax lien states, it’s all about the interest rate. This is where you make your money. Rates can vary wildly depending on the state. You’ve got Arizona sitting pretty at 16%, Florida at a lovely 18%, and Alabama at a solid 12%.

But here’s the catch — when you’re bidding, you’re likely to snag these liens at rates between 3% and 7%. Not bad at all, is it?

Now, here’s a little story…

Back in the day, smaller investors were raking it in with local tax liens. But then, the big guns — banks, hedge funds, you name it — came in and started bidding, driving those interest rates down. So while you might not be making a fortune, investing in tax liens can still be a sweet deal if you play it smart.

Consider the following benefits:

- Steady Returns: Those interest rates mean steady, predictable returns. It’s like a more exciting savings account.

- Low Entry Barrier: You don’t need big bucks to start. With some research, you can start small and grow.

- Diversify Your REI Business: Tax lien investing is a great way to diversify your real estate investment business. It’s a different kind of thrill, different rules, different game.

Investing in tax liens in tax lien states can be a smart move. You’ve got steady interest rates, a low barrier to entry, and a chance to spice up your REI business.

Just remember, like any investment, there’s risk involved. But with the right know-how and a bit of caution, you could be laughing all the way to the bank.

How Can I Profit from Tax Lien Certificates?

Ok, let’s talk about the meat and potatoes of tax lien investing: making a profit! Because let’s be honest, that’s a big reason why we’re all here, right?

When you buy a tax lien certificate, you’re essentially playing the interest game. You pay someone’s overdue taxes, and in return, they pay you back with interest. Think of it like giving a loan and getting a little extra for your troubles.

Now, this is where it gets interesting…

If the property owner doesn’t pay up, you might just end up owning a piece of property for a fraction of its value. It’s rare, but hey, it’s a possibility.

To really make bank in tax lien states, you gotta do your homework. Research the property, understand the risks, and know the rules of the auction game. It’s not just about throwing money at liens; it’s about strategic investing.

Interested in learning more about profiting from tax liens? Check out our Tax Lien Investing online course right now.

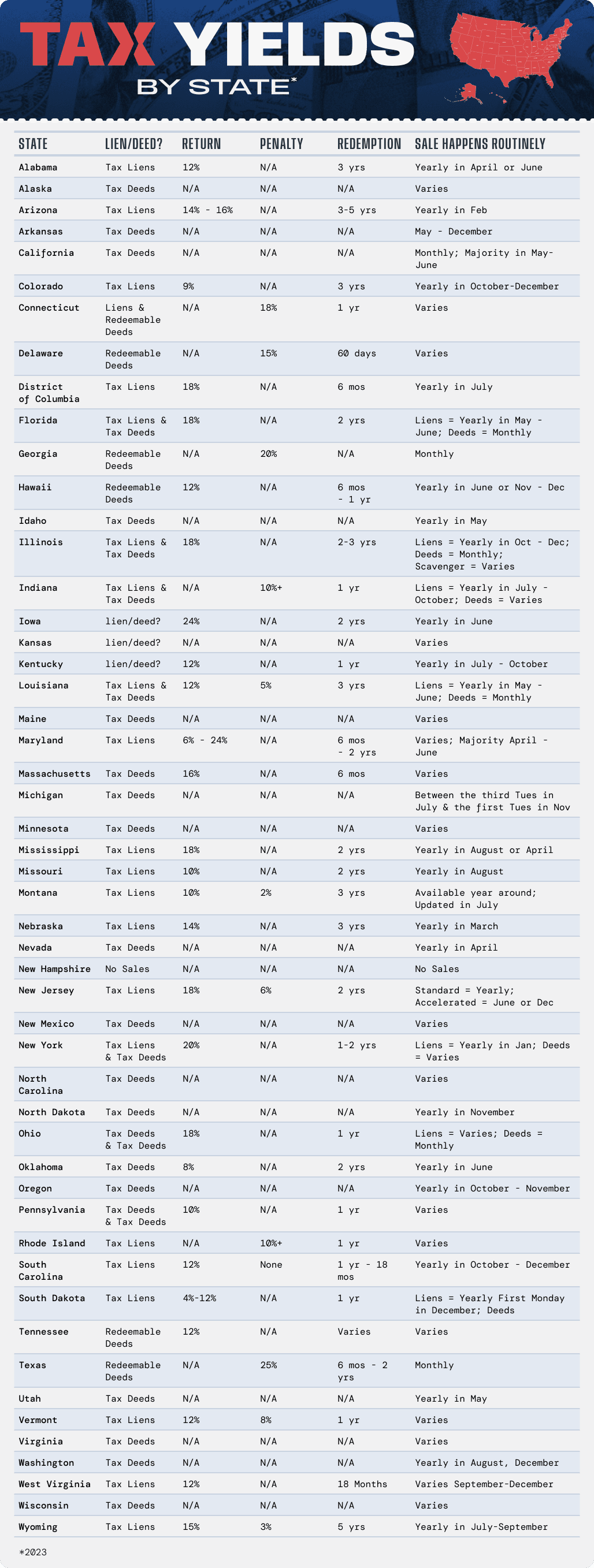

Full List of U.S. Tax Lien States

Look, I know you’re itching to know which states are tax lien states. So, to make it super easy for you, I’ve put together an infographic listing every single tax lien state in the U.S.

But I’ve done even better! It also shows you tax deed states, redemption periods, and more.

Check it out, and you’ll see at a glance where you can start investing in tax liens. It’s a real eye-opener!

Final Thoughts About This Complete List of Tax Lien States

That’s it — the whole shebang on tax lien states and how to profit from them. Remember, tax lien investing can be a lucrative avenue if you play it right.

Of course, you need to know the tax lien states before you get started, and that’s exactly what I’m hooking you up with today.

Taking part in the tax lien states means understanding the risks, doing your due diligence, and keeping an eye on those interest rates. Whether you’re a newbie or a seasoned investor, there’s something in the tax lien states for everyone.