One of the best parts about real estate investing is being able to choose the types of deals you do, right?

Did someone say à la carte?

Or perhaps, choose your own adventure?

So, you’ve got wholesaling, house flipping, rehab, buy & hold, house hacking, among other REI strategies.

But have you considered tax lien investing?

Although there’s a bit of a learning curve to fully understand all the moving parts of this method, tax lien investing can certainly be profitable if you take the right approach.

That’s where the best tax lien investing books come into play. By reading today’s top tax lien books, you can hear from today’s experts, what they did well as well as their mistakes, as you build your own knowledge of this real estate strategy.

Let’s get started!

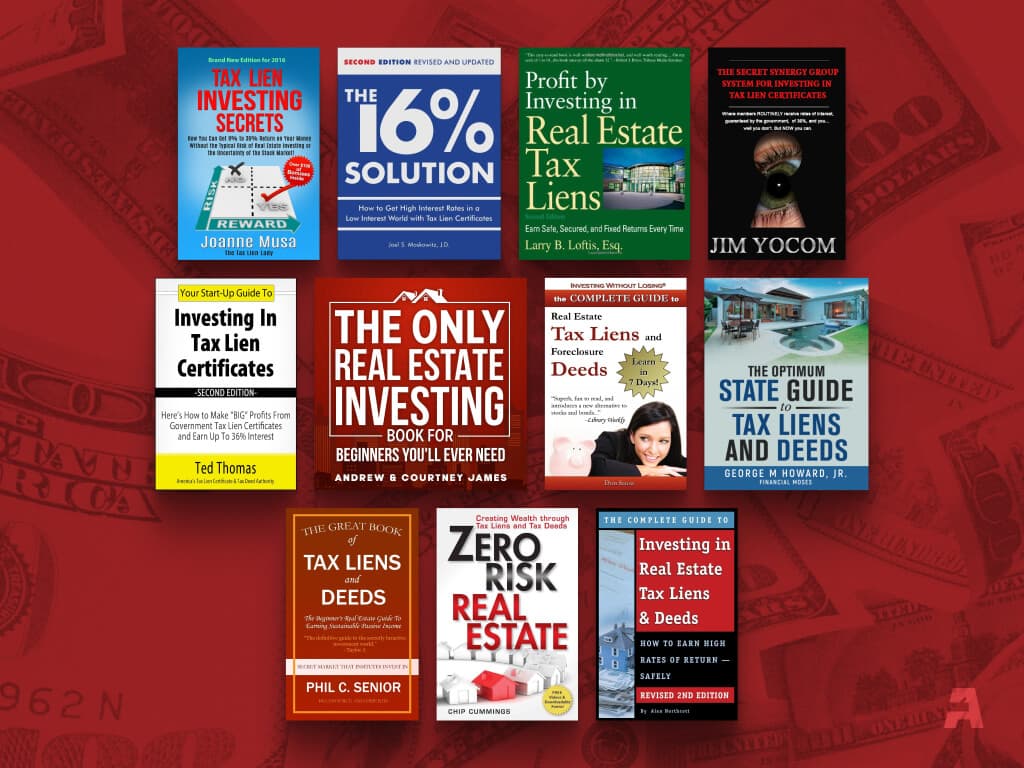

The Best Tax Lien Investing Books Right Now

If your curiosity is piqued, we encourage you to take a looksie at these books.

“The 16% Solution” by Joel S. Moskowitz

- A 200-page book that tells investors how to obtain high interest rates when investing in tax lien certificates

- Comprehensive guide to investing and personal finance that takes the broader economic situation into account

Check out this tax lien investing book on Amazon.

“Profit by Investing in Real Estate Tax Liens” by Larry B. Loftis

- Has a goal of helping investors obtain fixed returns ranging from 10%-25% when investing in tax liens

- Aims to debunk some of the myths surrounding tax lien investing while also answering common questions about the strategy

- Explores the risks involved with tax liens and talks about the various requirements in each state

You can learn more about this tax lien investing book on Amazon.

“Zero Risk Real Estate” by Chip Cummings

- Begins by taking a step-by-step approach to tax lien investing for beginners

- Uses real-life case studies and examples to support advice

- Shares highly advanced investing methods for experienced investors

Have a look at this tax lien investing book on Barnes & Noble.

“Tax Lien Investing Secrets” by Joanne Musa

- Explains the myths about tax lien investing and why they aren’t true

- Provides more in-depth strategies you won’t want to miss

- Aims to help investors reach double-digit profits with this strategy

You can learn more about this tax lien investing book on Amazon.

“Your Start-up Guide To Investing In Tax Lien Certificates” by Ted Thomas

- Promises to help investors like you make big profits with up to 36% interest

- Tells beginners how to invest in tax liens without spending a lot of money

- Includes step-by-step actions on how to locate nearby tax auctions

Check out this tax lien investing book on Amazon.

“Secret Synergy Group System For Investing In Tax Lien Certificates” by Jim Yocom

- Offers more than 300 pages that act as a complete guide to tax lien investing

- Talks about how to get interest rates guaranteed by the government

- Gives advice on how to find and take advantage of the best tax lien investment opportunities

Learn about this tax lien investing book on Amazon.

The Only Real Estate Book for Beginners You’ll Ever Need by Andrew James

- The name says it all: it breaks down everything you need to know about real estate and the tax lien process at large.

- Something I love about this tax lien book are the checklists that are included along with the information, making it easier to make sure you’re covering all the bases.

Learn more about this tax lien investing book on Amazon.

“The Complete Guide to Real Estate Tax Liens and Foreclosure Deeds” by Don Sausa

- This tax lien book encompasses the topic in its entirety with simple language and a clear plan.

- Keep in mind, it’s still up to you to follow through and apply what you learn, but I like how this book is one that can work for real estate investors at all levels.

Learn more about this tax lien investing book on Amazon.

“Tax Lien & Certificates Tax Deed Investing” by John I Osborne

- Focuses on both beginner and experienced real estate investors who want to invest in tax liens.

- What makes it so great? This tax lien book shows you different options and side-by-side comparisons to see what will work best for you.

Learn more about this tax lien investing book on Amazon.

“Tax Lien Investing Secrets” by Joanne Musa

- Takes you beyond the basics, including how to protect your investment.

- And better yet, Joanne Musa shows you how to have someone else do the work for you.

Learn more about this tax lien investing book on Amazon.

“The Optimum State Guide to Tax Liens and Deeds” by George M. Howard Jr.

- This book gives you everything you need to know state by state. Talk about comprehensive!

Learn more about this tax lien investing book on Amazon.

“Your Great Book of Tax Liens and Deeds Investing: The Beginner’s Real Estate Guide to Earing Sustainable Passive Income” by Phil C. Senior

- This tax lien book shows you how to start with little money, investing with as little as $50 or $100 to start, as well as bigger investments.

Learn more about this tax lien investing book on Amazon.

“The Complete Guide to Investing in Real Estate Tax Liens & Deeds. How to Earn High Rates of Return – Safely” by Alan Northcott

- Provides tips, facts, updated laws, and how to decipher the complex world of tax liens.

Learn more about this tax lien investing book on Amazon.

Final Notes: The Best Tax Lien Investing Books

With these books in hand, and the support of us here at Awesomely, you now have pretty much everything you need to dip your toes into tax lien investing.

Since this strategy isn’t widely used by investors, you should take all the help you can get to become acclimated to this investment method.

And BTW, there’s less competition with this niche, which makes it all the more enticing for you to jump into!

So… how’s about you make your first tax lien investment!?