In order to be a successful real estate investor, you must have a mastery of financial documents.

One of these critical documents is a proof of funds letter, because it’s almost like a financial passport.

A Proof of Funds letter is a powerful document because it authenticates a buyer’s financial capacity to fulfill the monetary aspects of a transaction, adding a layer of trust and reliability to their purchase offer.

It has many uses and purposes, whether you’re a tenant, landlord, or looking to become a real estate investor.

For example, a proof of funds letter may be needed by your landlord, or, if you are a landlord, you may require one during the application process.

A proof of funds letter can also be the difference between you as a real estate investor obtaining a rental property of your dreams, and you losing the deal to someone else.

A POF letter is a testament to the buyer’s financial stability, because it assures sellers that the proposed real estate transaction will be completed without financial hiccups — an indispensable instrument for clinching deals that makes every transaction smoother and more secure.

In this article, we’ll break down everything you need to know about a proof of funds letter, including how to obtain one as well as proof of funds letter template you can utilize.

Let’s get started!

What is a Proof of Funds Letter and When Will You Need One?

A Proof of Funds Letter is issued by banks or financial institutions. It’s a confirmation that an individual or entity possesses enough funds to conclude a transaction.

The Proof of Funds letter is crucial to real estate transactions, and you’ll need one if you are buying property, presenting all-cash offers, taking part in auctions, and securing rental properties.

The POF letter amplifies buyer’s credibility, smoothing out the negotiation process and providing sellers with peace of mind.

It’s a key document for reinforcing trust and facilitating successful transactions.

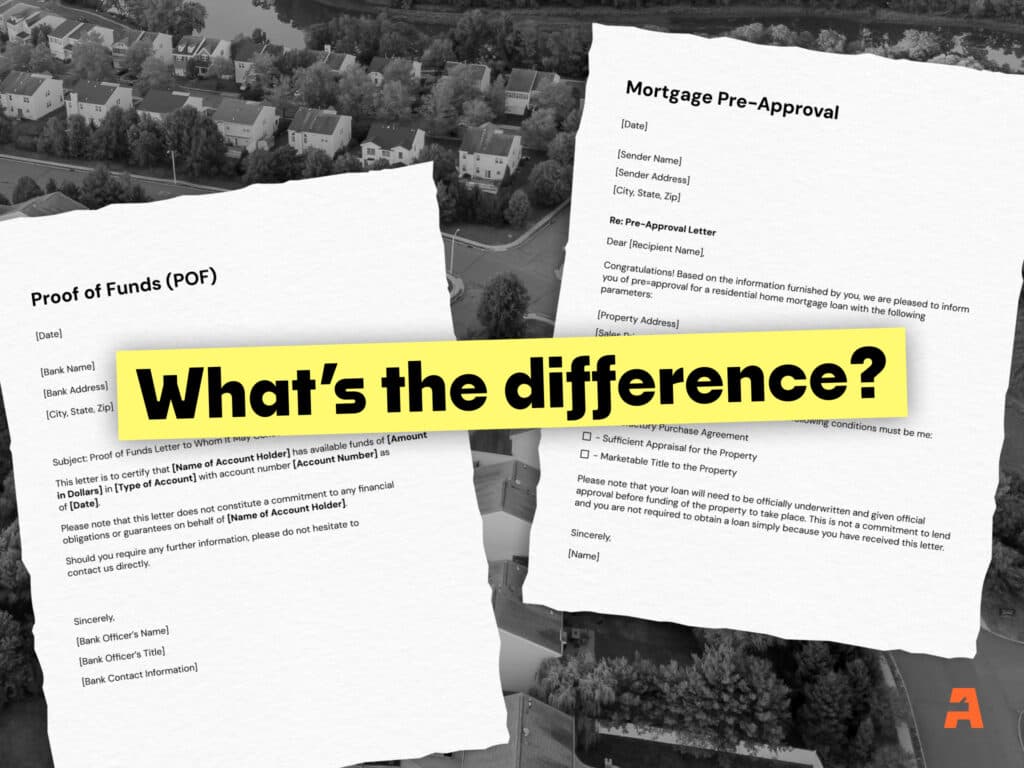

How Is A Proof Of Funds Letter Different From A Preapproval Letter?

Wait … doesn’t a proof of funds letter sound like a pre-approval letter?

While there are similarities, it’s important to not use the two interchangeably.

The POF letter demonstrates that the buyer has immediate access to the necessary funds by highlighting liquid assets.

A Preapproval Letter, on the other hand, is issued by a lender offers an indication of a buyer’s capability to obtain financing up to a certain limit.

This is based on initial financial assessments and centers more on future borrowing rather than the current state of asset ownership.

This is like a sneak peak into the buyer’s financial future, where the POF letter is a snapshot of the present.

What Counts as Income in a Proof of Income Letter?

Lenders and landlords seek verifiable, stable, and recurring income streams such as wages, salaries, business earnings, rental incomes, and investment returns to ensure coverage of payments.

Verification documents include but are not limited to tax returns, pay stubs, bank statements, and income statements, affirming the authenticity of the claimed income sources.

These verification documents not only validate the buyer’s income but also provide a comprehensive picture of their financial health, including their spending habits and debt obligations.

Proof of income lends credibility to your financial status when trying to obtain a Proof of Funds letter.

What Documents Can Qualify as a Proof of Funds Letter?

If you don’t ask your bank or financial institution for a specific POF letter, a variety of documents can qualify as a one.

Documentation that passes muster includes bank statements, money market accounts, and letters from banking or financial institutions verifying account balances.

In certain circumstances, an open line of credit might also be acknowledged as legitimate proof.

Any documents used for Proof of Funds must be up-to-date, detailing the financial institution’s name, the account holder’s name, and the current balance to be considered legitimate.

It’s also worth noting that the funds shown in these documents should be readily accessible and not tied up in investments that cannot be liquidated promptly, as this could potentially delay or even jeopardize the transaction.

Proof of Funds Letter Template

If you’re requesting a dedicated POF letter, it should be concise and contain all necessary information. Here’s a basic template:

[Date]

[Bank Name]

[Bank Address]

[City, State, Zip]

Subject: Proof of Funds Letter to Whom It May Concern

This letter is to certify that [Name of Account Holder] has available funds of [Amount in Dollars] in [Type of Account] with account number [Account Number] as of [Date].

Please note that this letter does not constitute a commitment to any financial obligations or guarantees on behalf of [Name of Account Holder].

Should you require any further information, please do not hesitate to contact us directly.

Sincerely,

[Bank Officer’s Name]

[Bank Officer’s Title]

[Bank Contact Information]

The Bottom Line: Proof of Funds Letter

There you have it: the many uses of a proof of funds letter.

It’s an indispensable asset in real estate investment to enhance your negotiation positions and simplify the purchasing process.